Ten years later, the cable bundle is under pressure. In the last decade, declining cable adoption was linked to declining home sales. Now it’s something different.

We’re watching the birth of a new era in media. It’s shifted from YouTube and Netflix and into the heart of the network TV business. New online streaming video offerings – “Over the Top” services– are gathering steam and redefining the business.

Here are five reasons why.

1. Cable/Satellite vs. OTT

In the golden age of cable, TV was simple. It was dominated by a handful of companies who collectively serviced most of the 116 million US TV households.

MVPDs collect billions from customers – then pay out 40-50% of gross… largely to the 10 or so companies that control 90% of TV networks. These include:

But then a funny thing happened: Netflix, Amazon and others began offering content from a better user experience – and for less money. As sub revenues and market cap increased, the new guys began spending billions on content. And consumers found a compelling alternative to cable and satellite.

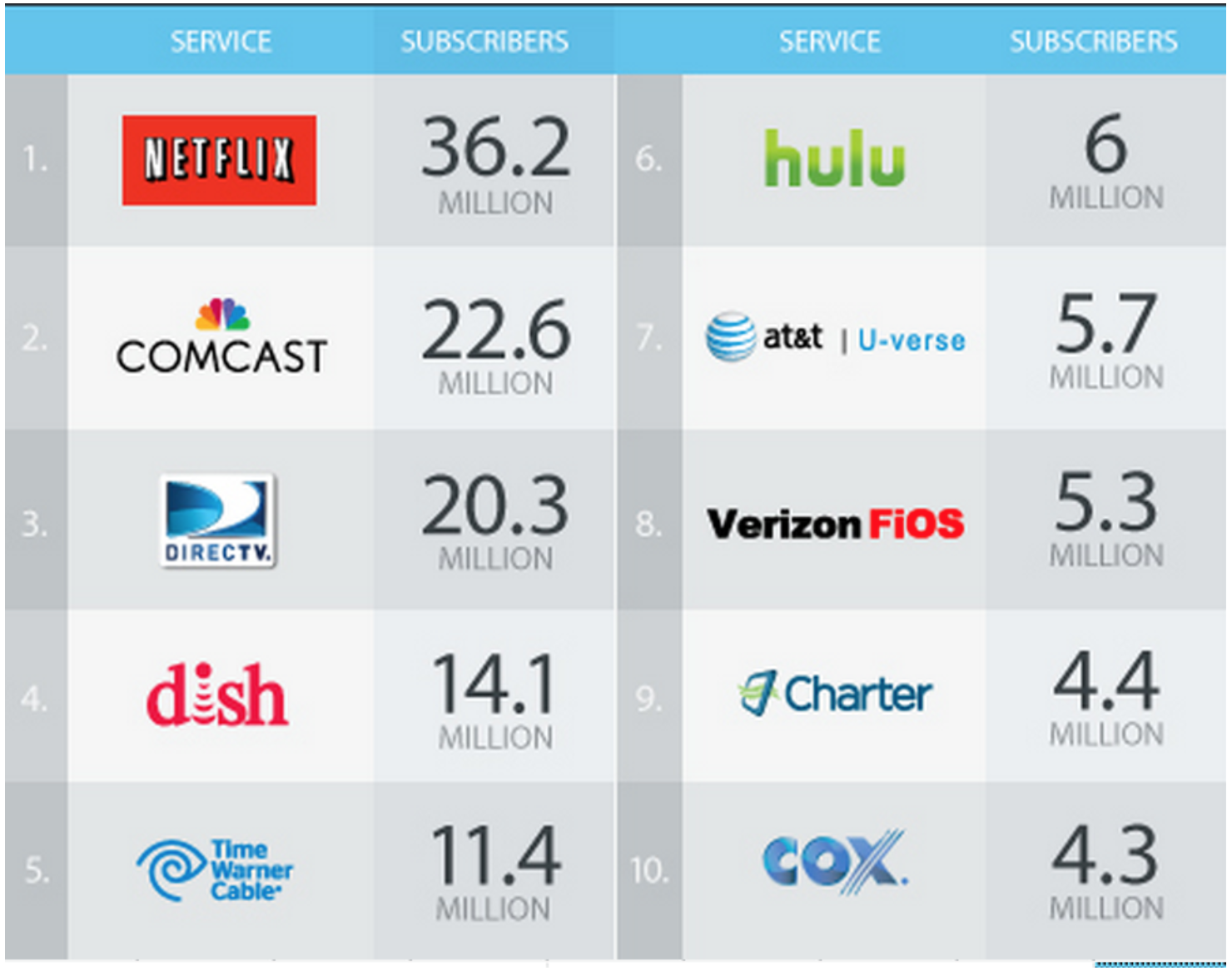

Now, the Top 10 video distributors look like this:

That’s a big change for the roughly $145 billion sub fee MVPD business.

2. WHOEVER OWNS THE CUSTOMER WINS

The increasing success of online video has encouraged networks to jump in the game. Though the lion’s share of their revenue comes from MVPDs, networks have good reason to innovate here.

Networks make their “wholesale” money selling to MVPDs… who then sell their product to customers. But what if they can sell directly to that customer, and cut out the middle man? Consider the potential increase in margin. Think about how much more data they’ll get, when they can speak directly with their audience – the way online businesses have been doing for decades.

At the very least, it dramatically increases their leverage in negotiating with MVPDs.

Think about how Apple owns the App world… how Amazon owns product sales… how Netlfix has grown from 0 to 57 million subs… and how each have a direct billing relationship with their customers.

Whoever owns the customer wins.

2. GENERATIONAL CONSUMPTION SHIFTS NEVER REVERSE

If you have kids under 16, you already know this: they watch a staggering number of YouTube hours. In 4 years, PewDiePie alone has garnered over 7 billion views – more than one view for every person on the Planet Earth. Every month, one guy in his apartment in Sweden generates almost twice as many views as The Huffington Post.

Most YouTube videos don’t generate significant revenue. But a portion of the top 1% are enormous. That’s another side of the next age of video consumption: Jenna Marbles and Grace Helbig can shoot on a camcorder in their bedrooms – and garner 1.7 billion views or a new show on E!.

Generational consumption changes are not subjective.

Top Ten YouTube Videos as of February 15, 2015

3. PREMIUM NETWORKS ARE LAUNCHING OTT

“We will go beyond the wall and launch a stand-alone over-the-top service with the potential to produce hundreds of millions of dollars in revenue.. We have a huge opportunity in front of us. We will use all means at our disposal to go after it”

– HBO CEO Richard Plepler

If that increases their negotiating leverage with MVPDs, so much the better.

4. SPORTS WILL LAUNCH OTT

The 800 pound gorilla of cable has long been sports. ESPN is the most valuable cable network by an order of magnitude – and the most valuable asset in the Disney portfolio. In fact, ESPN generates more revenue than the rest of the Walt Disney Company combined.

As the largest shareholder of Disney, Steve Jobs allegedly tried to craft a $30 package for Apple TV. The stumbling block was ESPN.

Even Steve Jobs couldn’t close that deal. But now, a short six years later, the economic levers have shifted – and ESPN is part of Dish Network’s new $20 Sling TV package.

4. NEWS IS NO LONGER A DEFENSE

For years. news was regarded as one of the bulwarks of TV subscription: no one who watched news could cut the cord.

The trouble here is that TV news reaches an older demographic – not the next generation that MVPDs need. According to The New York Times, the median age for MSNBC in May was 62.5. For CNN it was 62.8. For Fox News it was 68.8.

The Brian Williams scandal underlines this, encouraging a younger, already skeptical audience to believe what they already thought: that old school media folk are actors, pretending to be experts.

5. LINEAR KIDS’ CHANNELS ARE BEING GUTTED BY OTT

But we’re clearly in a new era.